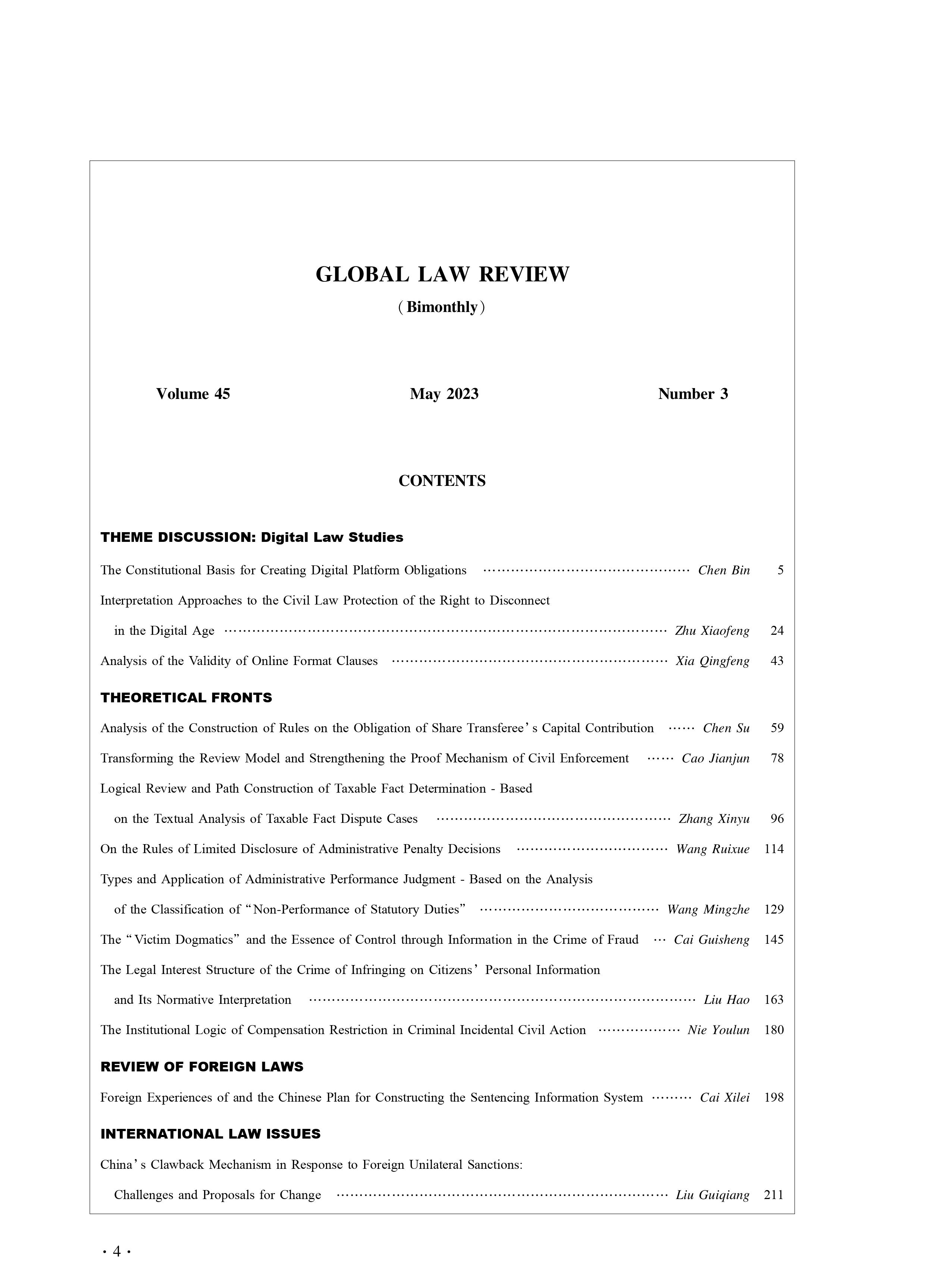

THEME DISCUSSION: Digital Law Studies

The Constitutional Basis for Creating Digital Platform Obligations

Chen Bin

[Abstract] How modern constitutional law deals with new types of social power is a key issue in the field of digital rule of law. The fundamental and general charter nature of the constitution means that constitutional mechanisms cannot be absent in the digital age. Since constitutional norms often embody relevant jurisprudence, it is urgent to promote the research of the digital rule of law from the perspective of constitutional law. In the platform society, digital platforms need to assume public obligations, but the basis of the obligations cannot be reduced to the dominant position, but stems from its composite power bundle structure. Specifically, organizational power, contractual power, and empowerment power are all intrinsic elements of digital platform power. In the digital age, the geometric relationship between state power and individual rights has indeed changed due to the addition of digital social power. In the new relationship, it is important to directly confront social power and find appropriate constitutional coordinates for it, rather than recognizing the importance of restraining social power but being subject to the inertia of thinking, and only finding indirect balancing solutions at the poles in the relationship between the state and the individual. In general, the rise of digital platform power has made it necessary for the concept of the constitution to be adjusted and integrated into the social constitutional concept. In the existing theoretical spectrum, the theory of the private effect of the constitution, social constitutionalism theory and the theory of digital constitutionalism all present the theoretical picture of the constitution’s intervention in social relations, but they also have inherent limits in practice. This means that, although the essence of digital technology is common in the global digital era and the results of digital platform power alienation are similar, there is no universal solution to the problems in constitutional governance, and it is still necessary to return to the historical tradition of the constitution and explore reasonable ways to respond to the problems. In the face of large-scale and covert platform power, the constitutional obligation mechanism needs to be re-examined. When returning to the “1982 Constitution”, it is possible to use the constitutional obligation mechanism to reasonably restrict the power of digital platforms from the systemic perspective of the fundamental law. The norms of obligations in the current constitutional law not only contain the basic obligations of citizens but also present a composite obligation system that includes a variety of social subjects. Specifically, the public obligations of digital platforms in constitutional law include the obligation to maintain legal order, the obligation to safeguard the community order, and the obligation to promote basic rights. In the digital context, the above obligations can play a positive role in the recordation and review of platform rules, the refinement of digital platform legislation, and the reasoning of administrative discretion and judicial judgment, thereby providing a constitutional perspective and shaping a solid digital rule of law order.

Interpretation Approaches to the Civil Law Protection of the Right to Disconnectin the Digital Age

Zhu Xiaofeng

[Abstract] In the digital age, the widespread use of digital technology has broken the once relatively clear boundary between workers’ work and life. Employers can contact workers anytime and anywhere through digital technology, affecting workers' living arrangements and rest outside working hours. The damage this causes to workers’ physical health, family life and freedom to make their own living arrangements may be incalculable. To deal with this problem, some countries have passed legislation to clearly establish the right to disconnect, giving workers the right to disengage from work and not to participate in work-related electronic communication during non-working hours. In contrast, China has not yet recognized the right to disconnect in legislation, and the existing right to rest in the labor law cannot fully address the problems addressed by the right to disconnect. We can provide normative support for the solution of these problems based on the general legal attributes of civil law and the attributes of the right to disconnect as a human right, a personality right, and a digital right. This is because there is a special law and general law relationship between labor law and civil law, and the right to disconnect itself has the attributes of human rights, personality rights, digital rights, etc. Specifically, Article 1032 of the Civil Code and Article 13 Paragraph 1 Subparagraph 2 of the Personal Information Protection Law, which provide for the right to peaceful private life and rules on the handling of workers’ personal information by the employer, can provide a normative basis for the solution of the problems to be solved by the right to disconnect from the perspectives of right protection and behavior regulation, respectively. In terms of the determination of specific tort liability, it is necessary not only to take workers’ consent into consideration but also to introduce the method of interest balancing when the constitutive elements theory does not work. Meanwhile, it is important to appropriately allocate the burden of proof to protect the legal rights and interests of workers. With regard to the protection of workers, it is also important to address the de facto power imbalance between employees and employers through the appropriate allocation of fault-proofing responsibility and urge employers to protect employees during non-working hours through fair, lawful and transparent measures. Due to the special legal relationship between employers and employees, employees are generally reluctant to claim remedies through the protection rules of civil law when their legitimate rights and interests are infringed on in practice. In this sense, the existing civil law rules in China may provide a last resort solution to the problems in the protection of workers that are the concern of the right to disconnect in comparative law. This also means that there is still a need to establish the right to disconnect in labor law, so as to protect the interests of both employers and workers in a balanced way.

Analysis of the Validity of Online Format Clauses

Xia Qingfeng

[Abstract] Online format clauses refer to contract clauses that are prepared in advance by an Internet Service Provider (ISP) and widely applied in cyberspace. They often appear in a specific form of electronic contract such as click-contract and browse-contract. Once the users express their acceptance through clicking confirmation or browsing behavior, the format clauses become legally binding. Online format clauses have efficiency value, and the efficiency gains they bring far exceed those brought by the free negotiation of contracts between ISPs and users. However, as format clauses are pre-prepared terms, they have problems of consensual defects, the illegality of content and so on, even though ISPs fulfill their obligation to provide explanations in accordance with current laws. The existing laws can satisfactorily deal with the defects in the performance of the duty to remind and explain the format clauses in traditional paper contracts, but cannot properly solve the validity dilemma of online format clauses. In paper contracts, the provider of format clauses is required by law to highlight important format clauses related to rights and obligations by using boldface, underlining, italics, etc. In cyberspace, however, users are in a more disadvantaged contracting position, lacking sensitivity to various traps in web pages and being completely unfamiliar with network technologies such as background-running programs. In addition, users’ urgency and bounded rationality to use network products or services may lead them to accept the format clauses provided by ISPs without knowledge or understanding. By taking advantage of their dominant position in the Internet environment and the objective situation of users’ unfamiliarity with network technologies, professional vocabulary, etc., ISPs often fail to fulfill their obligations of reminding and explaining as stipulated by the law, and even introduce unfair format clauses directly into click contracts and browse contracts, thereby obstructing the achievement of the legislative purpose of adjusting the unequal status of the parties as intended by the system of validity of format clauses. The emerging validity supplement measures can promote users’ understanding of format clauses to varying degrees and guarantee their privacy and property interests. But there are still some problems with these measures, such as inducing moral risks and leading to ambiguous judgments. Therefore, a hierarchical system should be constructed for the validity of format clauses to strengthen the performance of various obligations by ISPs (such as clarifying effective prompt obligations, providing opportunities for the review of the clauses, and improving user acceptance mechanism), encourage the parties to follow the principle of consideration, and promote the formulation of lists of valid clauses/invalid clauses by the regulatory authorities, etc. Such institutional arrangements, which involve ISPs, users and regulatory authorities, will be able to maximize the genuine consent of the parties in the contract activities in cyberspace and ensure that all parties are bound by fair and reasonable format clauses.

THEORETICAL FRONTS

Analysis of the Construction of Rules on the Obligation of Share Transferee’sCapital Contribution

Chen Su

[Abstract] In the case of the share transfer in a limited liability company with the system of subscription of registered capital, rules on the obligation of the transferee of share should be constructed in order to balance the effectiveness of resource allocation of share transfer with the effectiveness of credit protection of capital enrichment. These rules have been adjusted and enriched by the Draft Bill to Revise the Company Law on the basis of judicial experience, but they still have structural defects and application obstacles: they cannot effectively solve the problem of attribution of obligation for capital contribution in the case of multiple transfers of the subject share. Nor can they reasonably solve the long-term contingent liability burden caused by the non-application of the limitation of actions to the obligation for capital contribution, or strike a reasonable balance between the interests of various parties involved in share transactions under the subscribed capital system. The obligation for capital contribution under the subscribed capital system should be set as a burden on share so as to construct rules of obligation for share transferee’s capital contribution characterized by the “relationship in rem”. Only by setting the obligation to contribute as a burden on share, so that the obligation to contribute must be transferred with the share, can reasonable rules of obligation for the transferee of share be constructed, and the efficiency and effectiveness of the application of these rules be ensured. The performance of the contribution obligation should be divided into three categories, within each of which the liability for the contribution of capital between the transferor and the transferee should be set. (1) In the event that a shareholder transfers his or her share when the capital contribution period has not expired, the transferee of the share shall assume the capital contribution obligation upon the expiry of the capital contribution period and the transferor shall not be liable for the capital contribution. (2) Where a shareholder transfers his or her share upon the expiry of the capital contribution period but has not paid the capital in full, the transferee of the share shall be liable for the capital contribution and the transferor of the shareholding shall be supplementarily liable for any overdue payment; where the company has made a call on the transferor, the transfer of his or her shareholding shall be subject to the consent of the company. (3) If a shareholder transfers his or her share when the actual value of the non-monetary capital contribution is significantly lower than the amount of the subscription, the transferor of the share shall continue to be liable for the difference in the capital contribution, and other shareholders at the time the capital contribution is accepted by the company shall be liable for the contribution of capital in full, and the transferee of the share shall not be liable for the capital contribution. If the share transferee and the transferor are complicit in the false capital contribution, they shall be jointly liable for the difference in the capital contribution.

Transforming the Review Model and Strengthening the Proof Mechanism ofCivil Enforcement

Cao Jianjun

[Abstract] The regulation of executive elementary facts in the Draft Civil Enforcement Law, by mainly taking courts’ review behavior as its starting point, can easily lead to the problem of ambiguity and confusion among case review, executive review and substantive hearing. In the absence of external checks and balances, it is difficult to implement the binary standard for distinguishing between substantive elements and procedural elements. The review model of civil enforcement also has the problem of excessive expansion of the authority and scope of investigation and evidence collection by courts. The current centralized organizational structure and review model supplemented by substantiation cannot create effective internal constraints on courts’ investigative authority. As a result, it is necessary for the legislation on enforcement to curb the expansion of courts’ ex officio investigation from the external perspective of parties’ proof, so as to provide factual information and evidentiary clues for rapid identification of material facts and further promote the separation of trial procedure and enforcement procedure. Substantive executive elementary facts include change and addition of parties, change and extinction of substantive claims, and the clarity of payment content of an enforcement basis. The fundamental difference between objection procedure and litigation proceeding lies in the proof procedure and method of evidence. If a party cannot achieve a high degree of probability in the formal review of his proof through limited documentary evidence and other evidence, he should initiate a dissent action of execution with a full oral argument and adequate evidence investigation. This method of differentiation can strengthen the diversion function of the objection procedure and prevent it from being turned into a litigation procedure. On the other hand, procedural enforcement elementary facts mainly include the elementary fact of case acceptance and the elementary fact of procedural legality. The case accepting division of a court should raise the standard of inadmissibility ruling to the level of obvious and significant violation of law so as to match the construction of the review procedure and fact-finding mechanism at the case acceptance stage. The adjudication division of a court should clarify the scope of the application procedure and the objection procedure as well as the differences among different adjudication procedures, so as to avoid the problems of repetitive reviews, contradictory rulings and divided reliefs by different enforcement departments. The review system of executive elementary facts should be standardized in terms of review standards, competition rules and unified rulings while the proof mechanism should be enriched in terms of proving right, proving procedure and procedural content, so as to establish a decentralized reform mechanism with enforcement judge as the core and a systemic institutional pattern focused on the system of enforcement relief.

Logical Review and Path Construction of Taxable Fact Determination

- Basedon the Textual Analysis of Taxable Fact Dispute Cases

Zhang Xinyu

[Abstract] Disputes over taxable fact determination are one of the main types of tax litigation. The qualitative analysis, based on selected keywords, of 312 cases of dispute over taxable fact determination identified from 800 tax litigation judgments reveals multiple conflicts and contradictions in the determination of taxable facts at both the substantive law level and the procedural law level in practice. Firstly, in the specific operation of tax law, the independence boundary of tax law is often extended by the principle of substantive taxation. Although theories represented by substantive taxation focus on the use of fact determination, the tax composition elements system on which taxation depends inadvertently simplifies the steps of factual inference and proof. Secondly, both the anti-tax avoidance legislative system and the tax assessment legislative system in China adopt a two-element legislative structure of subjective intent and objective substance in which objective substance aims to determine whether taxable income has been reduced while subjective intent requires taxpayers to prove that they have “reasonable commercial purposes” or “legitimate reasons”. The legislation does not clearly define what constitute “reasonable commercial purposes”, and there is considerable flexibility in the determination of taxpayers’ subjective intent. Finally, in the current application of tax law, disputes over factual relationships are often merged with qualitative behavior, affecting the understanding and grasp of objective facts for taxation. Fact relationships, represented by economic substance, often deviate to some extent from factual relationships themselves due to the qualitative shaping and characterization of tax law. Faced with the absence of and loopholes in taxable fact determination logic, it is necessary to establish a dynamic substantive system based on fact determination as the primary link in taxable fact determination. Firstly, distinctions between and identifications of factual elements should be made among the composition elements, and in tax disputes, emphasis should be placed on proving the factual elements that constitute the composition elements, and the determination of individual fact should not be replaced by typified legal facts. Secondly, in a situation where the legal and factual premises are determinable, it is necessary to further verify whether the logical proofs in the process of capturing taxable facts are unified and complete, and to examine the gap between the composition elements caused by qualitative logic jumps and case facts. Finally, judicial organs should examine the tax normative documents on which the tax law application relies, so as to ensure that the legal basis conforms to the substantive purposes of higher laws. At the same time, evidence and reasoning should be provided for the verification of the authenticity of the factual premises, facts that do not meet the evidentiary standards should be re-determined, and the completeness of the captured logic and deduction should be demonstrated and explained. Generally speaking, the basic positions of the legal application logic and the judicial reasoning system in the taxable fact determination system should be reaffirmed, so as to establish the determination boundary of taxable facts.

On the Rules of Limited Disclosure of Administrative Penalty Decisions

Wang Ruixue

[Abstract] Disclosure of administrative penalty decisions refers to the public disclosure of government information related to administrative penalty decisions made by administrative organs against administrative counterparts with the degree of disclosure reaching the standard that administrative counterparts can be identified by the public. Article 48 Paragraph 1 of the Law on Administrative Penalty (as revised in 2021) stipulates that “decisions on administrative penalties that have certain social influence shall be made public in accordance with law”, thereby clearly setting out the rule of the limited disclosure of administrative penalty decisions. By adopting the standard set out in Article 20 Paragraph 6 of the Regulations on the Disclosure of Government (as revised in 2019), it realizes the unity of “general law” in the fields of administrative penalty and government information disclosure. However, various hierarchical norms that focus on government information disclosure, reputation sanctions and credit regulation still take “disclosure as the norm and non-disclosure as the exception”, and the limited disclosure rule is brushed aside. Administrative penalty decisions have three attributes: government information, public credit information and negative information, all of which have a natural tendency to expand the scope of disclosure. Meanwhile, the rules on timely disclosure and multi-channel disclosure have formed a strong support system for the rule of extensive disclosure. Against such a background, it is difficult for the limited disclosure rule, which lacks clarity, to counteract the existing rules, which operate almost automatically. The orderly review of relevant legal norms should be based on Article 48, following its original intention of moderation and balance as well as the requirements of the principle of proportionality, so as to balance the reputation interests of the individual with the public interest of achieving regulatory goals and eliminate norms that apparently contradict the rule of limited disclosure. Specifically, administrative organs can take the three-level administrative discretion model of “the subject of the illegal act - the object of the illegal act - the severity of the illegal act” as a reference to determine whether an administrative penalty decision should be made public in light of the specific regulatory situation, so as correct the widespread deviation of practice from the standard of “only disclosing decisions on administrative penalties that have certain social influence”. An administrative penalty decision should be disclosed if all the above-mentioned three dimensions suggest that there is a necessity to do so. If the results of judgments based on the three dimensions conflict with each other, then the “severity of the illegal act” should be the decisive criterion for the determination. In the process of exercising administrative discretion, an administrative organ should listen to the statements and arguments of the administrative counterpart, rather than making the determination through automated administrative procedure. The limited disclosure rule should also be supported by other prudent disclosure rules, such as those on objective presentation of the disclosure content, limitation on the disclosure channels and appropriate suspension of disclosure.

Types and Application of Administrative Performance Judgment

- Based on the Analysisof the Classification of “Non-Performance ofStatutory Duties”

Wang Mingzhe

[Abstract] Performance judgment is an important type of judgment in China’s administrative litigation, but the provisions of the Administrative Procedure Law and related judicial interpretations on the condition of application and methods of performance judgment are relatively simple, making it difficult to deal with various problems in judicial practice. There are actually various demands behind a party’s request for the performance of statutory duties by an administrative organ. Therefore, performance judgments should be classified according to different types of “non-performance of statutory duties” and specific analysis should be conducted on each of them. According to the two standards of “upon application -ex officio” and “no response - unlawful refusal to perform duties ”, “non-performance of statutory duties” can be preliminarily divided into four types. However, for ex officio administrative acts, administrative organs do not bear the obligation to respond. So, there are essentially only three types of “non-performance of statutory duties”, namely, refusal to respond to applications, unlawful rejection of legitimate applications, and unlawful refusal to perform ex officio administrative acts. Correspondingly, performance judgments can also be classified into three types: those requiring a response to the application, those requiring the approval of the application, and those requiring the performance of an ex officio administrative act. The first type of performance judgment applies to situations where administrative organs fail to respond to applications. When a party submits an application in the normative sense to an administrative organ and the administrative organ fails to perform its duty to respond to the application, the court can consider making a performance judgment. In terms of the judgment method, procedural judgments should be adopted in order to maximize respect for the administrative organs’ right to make the first judgment and reduce the burden on judicial organs. The second type of performance judgment applies to the situation where an administrative organ illegally rejects a legitimate application. In such a situation, the court should, in principle, make a judgment ordering the administrative organ to revoke and retake the administrative act. If there is no need for administrative investigation and discretion, substantive performance judgment should be made. The third type of performance judgment requires an administrative organ to intervene against a third party. This type of performance judgment requires a balance between the right of a third party to defend himself against improper intervention and the right of the applicant to request administrative intervention. Therefore, its application conditions should be stricter than those of the first two types of performance judgments, which should include the satisfaction of not only the requirements of “no need for investigation” and discretion but also the requirements of significance and supplementation. In terms of judgment method, the court should adopt substantive judgment. If the above conditions are not fully met, the court should reject the party’s claim, rather than make a procedural judgment.

The “Victim Dogmatics” and the Essence of Control through Informationin the Crime of Fraud

Cai Guisheng

[Abstract] In the constitution of the crime of fraud, the so-called “victim dogmatics” denies the responsibility of the perpetrator when the victim violates his duty of care. This approach can certainly limit the scope of punishment. However, it is problematic in terms of both criminal policy and the dogmatics of criminal law. In terms of criminal policy, it destabilizes the validity of the norms on fraud and contravenes the standpoints of legislature and judicature. In the dogmatics of criminal law, the perpetrator of fraud is responsible for the victim’s error: it is exactly because of this error that the victim’s “self-damage” resulting from the disposal of his own property can be recognized as the perpetrator’s “infringement on the property of another person” and thus is imputable to the perpetrator. The perpetrator is the “statutory principal by proxy” stipulated in the specific provisions of the Criminal Law because of his “control over the deed by making use of the error”. According to the legal principle of “principal by proxy”, the negligence of the instrument doesn’t preclude the “control over the deed through knowledge”. The “victim dogmatics” fails to pay adequate attention to the dogmatic structure of the “statutory principal by proxy” of fraud, thus contributing to the imbalance between crime and penalty. The appearance of “victim dogmatics” is the result of the distortion of the meaning of “suspicion” and compression of the judicial scope of “consent by the victim”. The original meaning of “suspicion” (dubitatio) is distrust of a relatively low degree. It doesn’t mean knowing (cognitio) the falseness of information concretely. Advocates of “victim dogmatics” have changed the meaning of “suspicion” in two independent ways. They either replace its meaning, which contains the error of the deceived, with the meaning of “no error”, or artificially add the adjective “concrete” to “suspicion”, so as to accept the “consent by the victim” and preclude the wrongdoings of the perpetrator, but such approaches have already exceeded the limits of the wording set by the criminal law. Besides the wording of “suspicion”, the terminology “fault” is also abused under the “victim dogmatics”. The changing of wording and terminology has made it more difficult for citizens to predict the consequences of criminal law and contributed to the arbitrariness of the judgment of criminal wrongdoings. If the existing cognitive framework of the wording of “suspicion” and the scope of “consent” is maintained, there would be no room for the application of “victim dogmatics”. Since fraud is a crime against property in China, only the kind of “control through information” aimed at the conditions of a rational transfer of property in modern society constitutes the “control through information” in the crime of fraud. The concrete characteristic of the dogmatic structure of “control through information” is that the perpetrator manipulates the process of communication by falsifying the relevant information and thus causes an error in the understanding of facts by the victim. This structure of “control through information” can be applied to the circumstances of fraud through implied statements, fraud by means of omission and situations of valuation.

The Legal Interest Structure of the Crime of Infringing on Citizens’Personal Informationand Its Normative Interpretation

Liu Hao

[Abstract] Regarding the legal interests protected in the crime of infringing on citizens’ personal information, there are certain misunderstandings in the existing paths and objects of the cognition of legal interests. The criminal law cannot directly take the legal interests of preceding laws as its own because the criminalization of the infringements on new rights and the disruption of management order cannot be directly measured by the degree of illegality. The theory of rights and interests can easily lead to confusion in the regulation by criminal law and preceding laws. The theory of information management order will be faced with the issue of the legitimacy of criminal law protection. The legal interests and illegality judgment of the crime of infringing on citizens’ personal information show the obvious characteristics of overall legal interest structure corresponding to the systemic perspective of the overall legal order. The legislative purpose of the crime of infringing on citizens’ personal information should be to prevent the actual harm of the crime. The logic of the norms on this crime belongs to the logic of special abstract dangerous crimes. The legal interest content of the crime of infringing on citizens’ personal information is personal information-related personal and property safety of other persons. If an act of infringement on personal information meets the relevant conditions provided for by the Criminal Law and its relevant judicial interpretations, it should naturally also constitute the crime of infringing on citizens’ personal information. As an abstract dangerous crime, its type should be determined in light of the relevant provisions of the Criminal Law and the relevant judicial interpretations. If the danger to other rights is taken as the standard, it is necessary to clarify the type of danger and the criteria for its judgment. The judgment of “serious circumstances” in the crime of infringing citizens’ personal information should be related to the abstract danger to other personal information-related personal and property safeties, including the quantity principle of personal information embodied in the relevant judicial interpretations. The identification of the crime of infringing on citizens’ personal information needs to be made from the perspective of the entire legal system, taking into consideration of the special legal interest structure and normative type of the crime and following the judgment of legal interest logic and content of the crime as an abstract dangerous crime. The relevant judicial interpretations should reserve appropriate space for the decriminalization judgment. The standard based on the theory of quantity in judicial interpretations only defines the formal standard on the causes of abstract dangers, the specific normative interpretations should reasonably limit such abstract dangers. In light of its legal interest structure, the crime of infringing on citizens’ personal information should mainly regulate the abuse of information, which is closer to the personal and property security risks of others and, therefore, should also be prohibited by norms in the sense of criminal law in an interpretive theory or in legislation.

The Institutional Logic of Compensation Restriction in Criminal IncidentalCivil Action

Nie Youlun

[Abstract] This article discusses the historical causes, theoretical contradictions and operational logic of the compensation restriction in criminal incidental civil action, providing an overall explanatory framework for understanding the institutional pattern of compensation restriction in criminal incidental civil action and its normative context. First, the scope of compensation in criminal incidental civil action was restricted to “material damages” by the 1979 Criminal Procedure Law, which was a direct consequence of the transplantation of Soviet law in form, but determined by the economic base in substance at that time, when the existence of the unit system and the ration system made it neither feasible nor necessary to implement full compensation for civil tort. Subsequently, with the deepening of reform and opening up, a tort liability system was constructed based on civil norms and the principle of comprehensive compensation under the conditions of the market economy, and the initial motive of compensation restriction has been dissolved, but the criminal norms introduced in succession imposed stricter compensation restriction in incidental civil action, leading to the problem of incomprehensible systemic integration. For the court system facing multiple conflicting goals and having to choose one for action, the relative disunity of the legal order that emerged in theory is merely the price of improving the effectiveness of judicial governance in practice: narrowing the scope of compensation will reduce the amount of compensation awarded. The smaller the object of execution, the less difficult it is to be enforced, while the higher the execution rate, the easier it is to settle the case. In fact, the compensation restriction largely upholds the logic of serving the non-litigation system rather than the litigation one: it can strengthen the application of the principle of “stimulating compensation through sentencing leniency” and improve the defendant’s willingness and ability to compensate, while the significant reduction of litigation proceeds will prompt more victims to choose mediation and reconciliation to obtain actual compensation no less than the amount awarded, which helps the court to persuade the parties to reach and fulfill the compensation agreement, thereby completely resolving the dispute and finally achieving a relative balance of interests of all parties. The current academic consensus is to abolish the compensation restriction and apply the compensation standards of pure civil cases to incidental civil action. However, according to the logic that the Chinese court system follows the ethics of responsibility and focuses on effective judicial governance, simply abolishing the compensation restriction in accordance with the requirement of systemic integration will do more harm than good to the macro judicial governance of incidental civil disputes. The only way to abolish the compensation restriction while maintaining effective judicial governance is to build a comprehensive national judicial assistance system for victims. China can take social assistance funds for road traffic accidents as a reference and consider adopting the social assistance fund model to expand funds and provide full compensation to victims.

REVIEW OF FOREIGN LAWS

Foreign Experiences of and the Chinese Plan for Constructing the SentencingInformation System

Cai Xilei

[Abstract] The sentencing information system, by collecting and sorting out past sentencing precedents, enables judges to search for effective precedents in the system that are most similar to the case under trial. By examining the types and scope of sentencing factors in these effective precedents, the impact of sentencing factors on sentencing, the distribution of sentencing conclusions and other details of the precedents and combing them with their own sentencing experience, judges will be able to reach a sentencing conclusion that is consistent with the overall sentencing experience in the past and most suitable for the case under trial. This sentencing information system, which takes judges’ previous sentencing information as a reference to provide guidance for the trial of cases and has operated in four provinces in Canada, New South Wales in Australia, the High Court of Justiciary in Scotland, Northern plural-chamber courts in the Netherlands and courts in Israel and other jurisdictions, is conducive to the realization of sentencing balance. The sentencing practice based on statutory sentencing guidelines in China in the past decade has received mixed reviews. While achieving standardization of sentencing, it also has many drawbacks, such as restricting judges’ discretion. Establishing a similar case retrieval system and constructing “smart courts” provide a normative basis and technical support for the construction of the sentencing information system in China. By building a two-dimensional system with sentencing guidelines as the basis and the sentencing information system as the supplement, China can adequately address many shortcomings of the one-dimensional sentencing guide scheme. Furthermore, the sentencing information system also has three major functions, namely ensuring the reasonable application rate of the sentencing guidelines, providing convenient channels for individual judges to learn from past sentencing experience, and providing practical sentencing information to the competent department responsible for sentencing guidelines. In terms of the preliminary construction of the sentencing information system, because currently the sentencing reasoning system has still not yet been implemented in a substantive way, it is difficult for China Judgments Online to achieve true and comprehensive transmission of sentencing information. Unconventional content such as sentencing departure should be filled in by judges in the form of written descriptions. In the long-term construction of the sentencing information system, once the basic system is functioning properly, the task of using this system to establish a dynamic balance between sentencing and prison resources can be placed on the agenda. Through sentencing data analysis, decision-making departments can provide a decision-making basis for the timely adjustment of prison resources from a macro perspective, and factors that cause abnormal sentencing can be accurately located through big data analysis, and the provisions of “sentencing guidelines” can be made highly scientific and rationalized from a micro perspective.

INTERNATIONAL LAW ISSUES

China’s Clawback Mechanism in Response to Foreign Unilateral Sanctions:Challenges and Proposals for Change

Liu Guiqiang

[Abstract] For the purpose of protecting national sovereignty, security, and developing interests, China has recently enacted a number of blocking statutes, including the Anti-foreign Sanctions Law (the AFS Law). Among all the countermeasures provided for by China’s blocking statutes, the clawback mechanism established by Article 12 of the AFS Law merits particular attention. On the one hand, the clawback mechanism provides Chinese private actors with a right of action to recover damages suffered as a result of the unjustified extraterritorial application of foreign sanctions laws. On the other hand, such a mechanism may be capable of deterring foreign parties from engaging in activities that are contrary to China’s national interests. The effectiveness of the clawback mechanism, however, is uncertain due to some procedural challenges. This paper examines three main procedural challenges faced by China’s clawback mechanism and proposes corresponding solutions. First, there is a lack of coordination between clawback civil litigation and administrative enforcement proceedings. According to Article 12 of the AFS Law, the existence of “foreign discriminatory restrictive measures” is the precondition for the initiation of clawback civil litigation. It is unclear, however, whether people’s courts or administrative authorities have the power to make such a decision. This paper argues that a Chinese court should make its own decision on this issue without interference from administrative authorities. Meanwhile, in order to avoid conflicting decisions between people’s courts and administrative authorities, it is also suggested that China should establish and improve the information communication mechanism between these two kinds of institutions. Second, people’s courts may lack a basis to assert jurisdiction in clawback civil litigation. Article 272 of China’s Civil Procedure Law provides for six bases on which a Chinese court can exercise jurisdiction against foreign defendants. However, a Chinese court might not be able to exercise jurisdiction in clawback litigation if none of the six jurisdictional bases is located within China. The “appropriate contacts” standard introduced by the Draft Amendment to the Civil Procedure Law could address this issue since it gives the Chinese judges more discretion in exercising jurisdiction. Therefore, this article suggests the “appropriate contacts” standard to be formally introduced into China’s Civil Procedure Law. Third, China could face significant challenges in seeking the recognition and enforcement of Chinese clawback judgments in foreign courts. On the one hand, a U.S. court may refuse to recognize and enforce a clawback judgment made by a Chinese court against a U.S. party out of public policy concerns. On the other hand, it is uncertain whether a third country would recognize and enforce the clawback judgments rendered by Chinese courts. In order to enhance the recognition and enforcement of clawback judgments, this paper suggests that China strengthen judicial cooperation with foreign countries that are also facing U.S. unilateral sanctions.